Why the Tail Might be Worth Chasing

After decades of relentless optimisation and digital evolution, corporations around the globe have gotten their strategic spend down to a science.

By implementing rigorous Request for Quote (RFQ), Request for Proposal (RFP), and benchmarking processes, enterprises are likely to secure the most competitive prices in the market.

And while the corporate world was focused on honing their strategic spend to near perfection, their indirect and tail spend management quietly slipped through the cracks.

In recent years however, businesses are finally turning their much-deserved attention to tail spend.

Tail spend in a nutshell

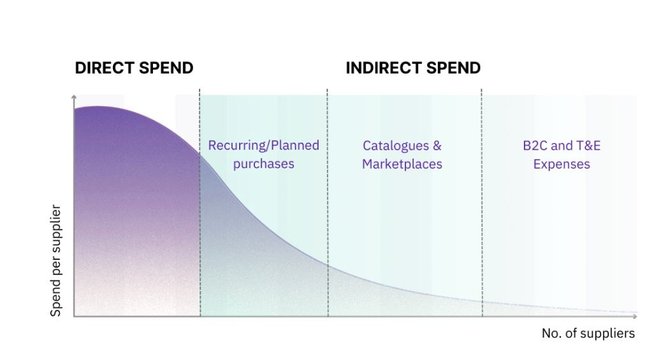

Tail spend, often referred to as indirect, maverick, or rogue spending, accounts for 20% of a company's overall expenditures. In line with the Pareto Principle, this 20% encompasses 80% of the total supplier count.

Someone unfamiliar with procurement processes may not fully grasp the challenges and headaches this poses for a company.

Research has shown that it can take up to 6 months for a large organisation to onboard a single supplier onto their ERP systems. Thus, it makes little business sense to onboard a one-time, low-spend supplier.

In industries such as pharmaceuticals, where security and compliance are paramount, businesses have to navigate a significant amount of red tape just to initiate a payment.

Given that the majority of tail spend is made up of these low-value suppliers, it comes as no surprise that 74% of CPOs surveyed in Deloitte’s 2023 Global Chief Procurement Officer survey identified “driving operational efficiency” as their top priority.

Making sense of the tail

The tail can be divided into three main categories - Planned purchases, catalogues and marketplaces, and typical expenses.

Most procurement teams have a good handle of their B2C and Travel and Entertainment (T&E) expenses. This can be attributed to the fact that most of these payments can be made with credit cards or purchasing cards (P-cards).

In fact, P-cards are already used by around 72% of companies as an alternative purchasing method to traditional cheque payments or bank and wire transfer.

Once connected to an enterprise’s Expense Management System (EMS), these cards act as a single point of contact, facilitating smoother reconciliation and enhancing visibility.

Unlocking 100% card acceptance

What if there was a solution that could allow you to treat all tail spend payments as simple expenses, providing a sole touchpoint for hundreds, or even thousands of ad-hoc, low-value suppliers?

Unlike the B2C environment, where merchants have largely been pressured to accept card payments, card acceptance in the B2B sector remains surprisingly scarce.

This is precisely where emerging Fintech companies like Billhop truly come to the forefront.

Billhop’s groundbreaking buyer-funded solution allows enterprises to pay any supplier with their commercial credit card.

Businesses can save time and resources by eliminating the need to onboard their suppliers.

This is an especially elegant solution for managing tail spend transactions, where the cost of onboarding a single supplier can range from 10% to well over 100% of its principal amount.

Free up cash flow

By paying their tactical suppliers and marketplace invoices by credit cards, businesses can leverage their interest-free payment days and better manage their cash flow.

Additionally, most suppliers offer early payment discounts in a bid to get paid earlier.

Credit cards empower businesses to pay their suppliers on time and negotiate better payment terms.

This strategic approach allows them to preserve funds for as long as possible, ultimately improving their working capital without the need to resort to loans or factoring.

Limitations of spend management platforms

A quick search on Google for Tail spend solutions will return countless webpages touting the latest AI and machine learning spend management platforms.

While these solutions are invaluable for enterprises to identify opportunities for savings and gain greater visibility over their entire source-to-pay procurement processes, they do not address the crucial issue of supplier payments.

They can be seen as a natural first step to tackling the headache that is tail spend.

Once enterprises have a good grasp of their spend, they can begin to look for better payment solutions that can allow them to minimise the amount of time, money and resources spent on onboarding many ad-hoc, low volume suppliers.

Billhop: A single touchpoint for tail spend purchases

Billhop is a leading B2B payments platform that allows large corporations to pay any supplier invoice with their existing credit and purchasing cards.

With Billhop, businesses can pay all tail spend suppliers without onboarding them to existing ERP systems.

By the same token, suppliers will not be required to make any changes to their existing receivable process as they will be paid by means of a regular bank transfer.

By eliminating the need for supplier onboarding, procurement teams can better allocate their manpower and resources to more productive tasks such as vendor management and contract negotiations.

Visit billhop.com today to streamline supplier payments and maximise the use of your P-cards today.

******

Billhop CFO Ingemar Sjögren is an accomplished financial executive with a diverse career that encompasses investment banking, strategy consulting, and group management within a multinational manufacturing group. He is currently serving as the Chief Financial Officer at Billhop.

- This is promoted content