Agility and autonomy are vital to the future of SEG Automotive’s supply chain

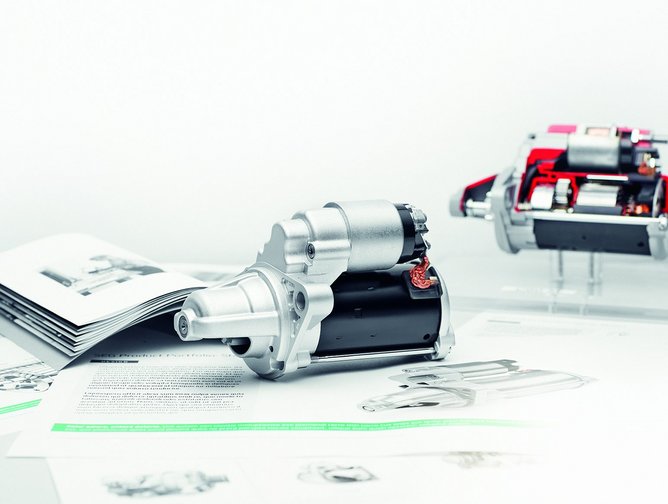

Conventional wisdom dictates that, when leveraging bargaining power, the bigger the company, the better the deal. In January 2018, the Starter Motors and Generators division of multinational engineering and electronics company, Bosch, completed its transition to become an independent organisation. Trading under the name SEG Automotive, now owned by Chinese consortium Zhengzhou Coal Mining Machinery Group (ZMJ) and China Renaissance Capital Investment (CRCI), the company is continuing to push the envelope of powertrain solutions for combustion engines and electrification in the automotive sector. “Our new advantages include being more flexible, faster and more able to incorporate supplier innovation,” explains Nina Bomberg, Global Lead Buyer at SEG Automotive. Bomberg was hired by SEG in 2017 before the company’s carve-out was completed, taking the reins of a global procurement network readying itself to step into the future. She sat down to discuss SEG’s sourcing, procurement and supply chain strategy going forward, the company’s plans to become a world leading provider of electrification solutions, and why bigger doesn’t always equal better.

Bomberg has always enjoyed the unpredictable nature of a career in sourcing. “One day you need to rent an elephant and the next you’re finding a financial auditor,” she laughs. “I’ve always enjoyed the diversity.” Change in the procurement industry isn’t restricted to the day-to-day: over the past decade, Bomberg notes, the role of the supply chain executive and their department has evolved dramatically. “We've moved from being a purely cost-driven money saver to becoming internal consultants on a mission to create value for the organisation,” she says. “Cost saving is definitely still a part of our role, but we also focus on supply security, innovation and more.” The opportunity to join a company that was preparing to cross such a monumental threshold was an enticing one for Bomberg, who acknowledges that a large portion of the industry still has a long way to go in terms of supply chain evolution. “I joined a company in 2012 that was turning over multiple billions of dollars every year – yet they didn’t have an indirect sourcing department. The role of procurement is changing, but some companies have a longer way to go than others,” she says. With SEG, Bomberg’s excitement continues, not only to be working in a growth sourcing industry, but also to be part of a team that is at the forefront of the supply chain industry’s evolution.

“The biggest lesson I've learned at SEG is that what goes around comes around,” says Bomberg. “How you treat the other side of the table is crucial. You can be tough when you negotiate, but you should always be fair and treat people with dignity and respect.” Establishing respectful, mutually-beneficial, long term relationships between SEG and its suppliers is a vital aspect of Bomberg’s role in managing the company’s buying strategy. Communication between the company’s high-level decision makers and local buyers is essential to fully leverage employees’ expertise. “As global lead buyers, we are responsible for the overall purchasing strategy. We're also the ones coordinating the commodity buyers that SEG has spread around the world. We have local people doing the purchasing in the specific countries, as they are much closer to our internal business partners, as well as local legislation, regulations, taxation, local suppliers etc. If everything was done from the central office, we would not be able to operate with the same amount of flexibility and insights,” explains Bomberg. “It’s very important that, when we implement our strategies, we align closely with our specialist departments so they understand why we do or don't do certain things. In the sourcing space, a lot of things live and die by whether the internal business partners align with a strategy.”

SEG Automotive’s strategy of communication and collaboration also applies to their suppliers. “We’ve had extensive discussions with our supply base which allowed us to explain our mission of reducing global CO2 emissions, our new structures and showcase the additional benefits that we now bring to the table. In the past, we had many suppliers that were a good fit for the huge organization that is Bosch. Now, we develop suppliers that are perfect for SEG and our new size and speed. Very often that is a supplier we have worked with for many years, and in some cases it’s a new organisation,” she says. One of the new companies working with SEG is CHG Meridian, an IT services and leasing company from Weingarten, Germany. “Since the carve-out, we’ve had a very good relationship with CHG using their IT solutions,” Bomberg says. “Our next project will be to streamline our forklift fleet. CHG will definitely help us to align and organise it better.”

Bomberg notes that SEG’s more agile business profile is conducive to both increased levels of communication and adaptability. “Instead of the complex organization of Bosch, we now have a dedicated sourcing team that serves only SEG. With increased focus, process knowledge and more direct communication, intercultural and inter-disciplinary teamwork has become much easier. This includes regular visits of the global lead buyers to the local buyers around the world ,” says Bomberg, adding that the reduction in organizational complexity has allowed SEG’s team to cater its sourcing practices to the unique challenges of different markets. “Now it’s possible to have a supplier that only works in Brazil but is exactly right for that market, whilst for the other six countries where we produce, we buy from someone else.”

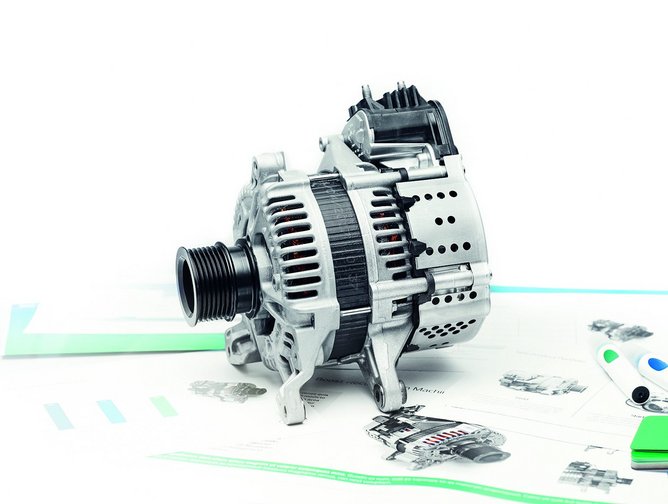

More focused, adaptable sourcing is giving SEG the ability to hone in on its long term goals: to further increase its contribution to reducing CO2 emissions from passenger cars and commercial vehicles, while also becoming a leader in electrification solutions. “The autonomy we have now means we set our own targets – and electrification is a key area of growth for us,” emphasises Bomberg. “We have the clear goal of being a technology leader in that field as well.” SEG’s new Chinese owners reflect the increasing maturity of the electric vehicle market in the Asia Pacific region. Bomberg asserts: “China has established itself as the largest car market in the world and is driving the change towards electrification.” European demand for solutions that reduce CO2 emissions is rising rapidly too and SEG is anticipating a continued surge in a market where it is already the key player. “48V mild-hybridization in particular will be a key technology in Europe, which is set to even outpace EVs in terms of market penetration. Just as with starter motors and generators before, we are a technology leader for 48V, which transforms any conventional internal combustion engine into an efficient mild-hybrid with minimal effort.”

The company is looking to expand its portfolio and improve upon existing products at its new R&D centre under construction in Changsha, China, which is collaborating across continents with the German R&D centre. “With this new facility, we’re able to further expand our research into powertrain solutions for the future, especially high-voltage components in preparation for fully electric vehicles,” says Bomberg. At the same time, the company also expands its product portfolio to answer regional mobility needs. SEG’s Indian division is set to introduce an electric motor designed to power e-rickshaws. The 2kW electric motor, christened the EM 1.2-HR (high range), has been developed to cater to the growing demand for e-rickshaws across many cities in India. "With the capabilities and collaboration of our Indian and German engineering teams, we have been able to bring the product from conceptualisation to reality in a record time of one year," said Anil Kumar MR, Managing Director, SEG Automotive India in an interview with Autocar Professional earlier this year.

Looking to the future, Bomberg expects to be at the heart of an increasingly diverse procurement network, as SEG further expands its product portfolio. “The automotive industry is facing a transformation – and SEG Automotive will actively shape this transition towards more efficient combustion engines, 48V hybrids and electrification,” she says. As an independent company, SEG may be more agile and focused, but Bomberg is confident that the company has lost none of its bargaining power when it comes to its relationships with a complex supplier network. “We are a smaller company now, no question. However, we are still a US$2bn multinational corporation and a global player in our segment. Despite the fact that it is not the size of Bosch anymore, SEG Automotive is still a market leader in its business fields and will continue to leave its mark.”