Essential findings: GEP Global Volatility Index October

The index is a leading indicator for procurement and supply chain professionals regarding conditions, shortages, transportation costs, inventories and backlogs based on a monthly survey of 27,000 businesses.

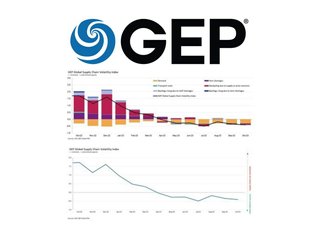

The GEP Global Supply Chain Volatility Index decreased again in October to -0.41, from -0.35 in September, indicating a 7th successive month of rising spare capacity across the world's supply chains. Additionally, the extent to which supplier capacity went underutilised was even greater than in September and August. This was coupled with October's downturn in demand for raw materials, components and commodities, this shows rising slack in global supply chains.

"While the shrinking of global suppliers' order books is not worsening, there are no signs of improvement," explained Jamie Ogilvie-Smals, vice president, consulting, GEP. "The notable increase in supplier capacity in Asia, which was driven by China, provides global manufacturers with greater leverage to drive down prices and inventories in 2024."

Three key insights

- Asia's suppliers have seen largest rise in idle capacity since June 2020 as the region's economic resilience fades

- Europe reported a 7th successive month of substantial excess vendor capacity, and 17th successive month of subdued demand, reflecting recessionary conditions

- Supplier spare capacity across North America is modestly rising highlighting greater economic resilience in the U.S. economy and its divergence from Europe

Recession has further to run

A significant finding from October's report was the strongest rise in excess capacity across Asian supply chains since June 2020. Sustained weakness in demand, coupled with falling pressures on factories in Asia, indicates that the global manufacturing recession has further to run. With the exception of India, which continues to perform strongly, large economies in the region, such as Japan and China, are losing momentum.

Suppliers in Europe continue to report the largest level of spare capacity. In fact, the lower levels in GEP's supply chain index for the continent have only been seen during the global financial crisis between 2008 and 2009. They highlight sustained weakness in economic conditions across the continent. Western Europe, particularly Germany's manufacturing industry, is a key driver behind the region's deterioration.

A relative bright spot is North America, where supply chains have excess capacity, but to a much lesser extent than elsewhere as the U.S. economy continues to display its resilience, in stark contrast to Europe.

Five key October 2023 findings

- DEMAND: Demand for raw materials, components and commodities remains depressed, although the downturn seems to have stabilised. There are still no signs of conditions improving, however, as global purchasing activity fell again in October at a pace similar to what we've seen since around mid-year.

- INVENTORIES: With demand falling, our data shows another month of destocking by global businesses, signalling cashflow preservation efforts.

- MATERIAL SHORTAGES: Reports of item shortages remain at their lowest since January 2020.

- LABOUR SHORTAGES: Shortages of workers are not impacting global manufacturers' capacity to produce, with reports of backlogs due to inadequate labour supply running at historically typical levels.

- TRANSPORTATION: Global transportation costs held steady with September's level, although oil prices have declined in recent weeks.

Key regional findings

- NORTH AMERICA: The index fell to -0.34, from -0.30. This remains much softer than the global average and continues to suggest the U.S. economy is poised for a soft landing.

- EUROPE: The index rose to -0.90, from -1.01, but still remains at a level that is indicative of considerable economic fragility.

- U.K.: The index edged slightly higher to -0.93, from -0.98. Still, the data point to a substantial rise in excess capacity at suppliers to U.K. markets.

- ASIA: Notably, the index dropped to -0.38, from -0.20, highlighting the biggest rise in spare supplier capacity in Asia since June 2020 as the region's resilience fades.

How does the GEP Global Supply Chain Volatility Index work?

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. It is derived from S&P Global’s PMI surveys and sent to 27,000 global companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

What do the values in the GEP Global Supply Chain Volatility Index mean?

A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing. The further above 0, the greater the extent to which capacity is being stretched.

A value below 0 indicates that supply chain capacity is being underutilised, reducing supply chain volatility. The further below 0, the greater the extent to which capacity is being underutilised.

The index is published once a month and you can review previous studies here.

*************************************************

For more insights into Procurement & Supply Chain - check out the latest edition of Procurement Magazine and be sure to follow us on LinkedIn & Twitter

Other magazines that may be of interest - Supply Chain Magazine | Sustainability Magazine

*********************************************

BizClik is a global provider of B2B digital media platforms that cover 'Executive Communities' for CEOs, CFOs, CMOs, Sustainability Leaders, Procurement & Supply Chain Leaders, Technology & AI Leaders, Cyber Leaders, FinTech & InsurTech Leaders as well as covering industries such as Manufacturing, Mining, Energy, EV, Construction, Healthcare + Food & Drink.

BizClik, based in London, Dubai & New York offers services such as Content Creation, Advertising & Sponsorship Solutions, Webinars & Events.

- North American Suppliers Struggling to Meet Demand – GEPSupply Chain Risk Management

- How to Get the Most From Supply Chain ConsultanciesSupply Chain Risk Management

- Key findings from GEP Supply Chain Volatility Index for JulyProcurement

- GEP supply chain Index warns of 'gathering storms'Supply Chain Risk Management